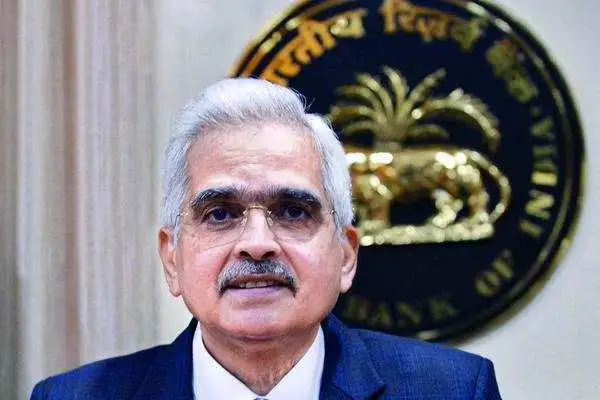

The Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday announced the first monetary policy of the financial year 2024-25. The RBI has announced its decision on the short-term lending rate, or repo rate today and is has kept it unchanged at 6.5%. The Governor Shaktikanta Das, who leads or is the head of the six Monetary Policy Committee (MPC), is going to announce the post policy press conference at 11 am today.

“Since the last policy, the growth inflation dynamics has played out favourably. Growth has continued its momentum surpassing all expectations. Headline inflation has eased to 5.1 per cent during both January and February,” Das also said.

He said that global economy has remained resilient with a stable outlook reflected in various high quality indicators.

“Credible consolidation plans particularly in major advanced economies focussing on growth advancing investments would be necessary to address this challenge…India presents a different picture on account of its fiscal consolidation and faster GDP growth,” Das said.

He also added to his statement that –

“Turning to domestic growth, domestic economic activity continues to expand at an accelerated pace, supported by fixed investment and an improving global environment,”

“The second advance estimates placed the real GDP growth at 7.6 per cent for 2023-24, the third successive year of 7 per cent or higher growth,”.

It is also expected to significantly boost overall market sentiment, pushing residential sales in the top seven markets of India to more than 3 lakh housing units in 2024, said experts.